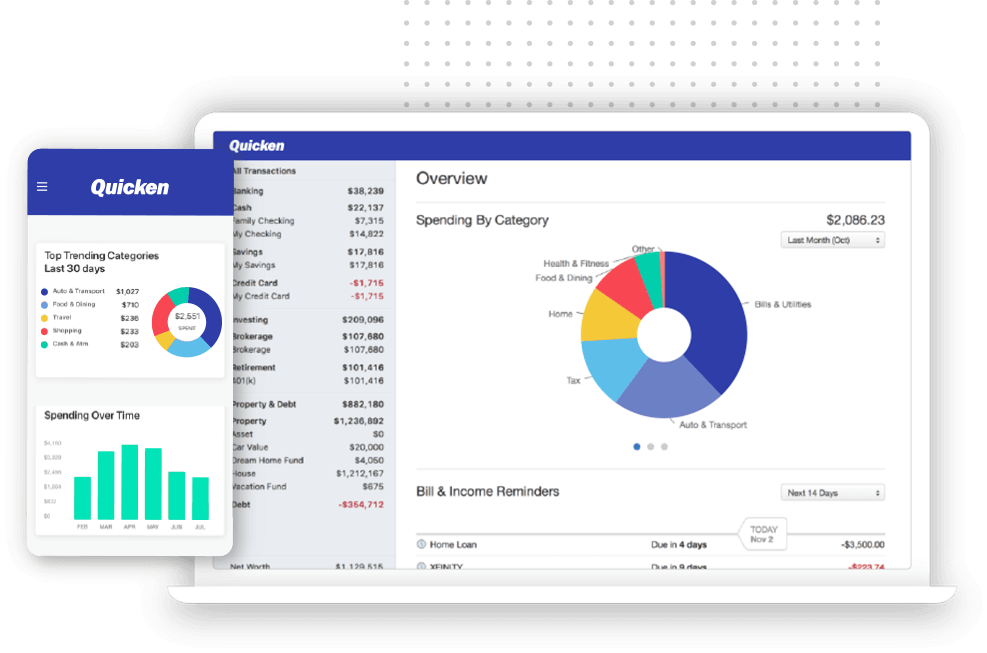

Software for managing personal finances called Quicken was created by Quicken Inc. It is made to make it easier for people and small businesses to manage their financial data, which includes loans, investments, credit cards, and bank accounts. Quicken has capabilities for managing investments, producing reports, setting up budgets, and tracking costs. Quicken users can also track investments, pay payments, and build personalized financial goals. Using its companion app, Quicken Mobile, Quicken is accessible on mobile devices and on both Windows and Mac operating systems. Let’s discuss about Quicken Setup in details.

The ability to combine all of your financial accounts in one location is one of Quicken’s main benefits. It follows that you can view all of your financial data, including that related to your bank accounts, credit cards, and investment accounts, in real time. You can take charge of your finances and make informed decisions about them with this knowledge.