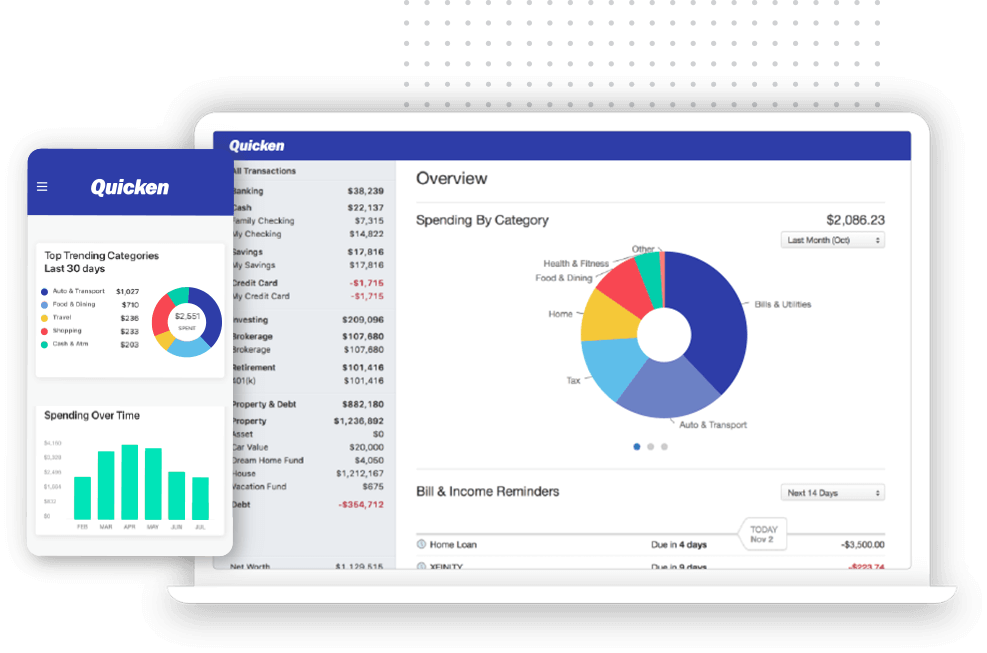

During the past three decades, millions of people have used Intuit Quicken, a personal finance management program, to effectively manage their accounts. Quicken is renowned for its extensive features, user-friendliness, and capacity to offer insightful information about individual accounts. We’ll go through the advantages of utilizing Intuit Quicken Help and how it may give you financial control in this blog post.

Intuit Quicken makes it simple for consumers to keep track of their money in one location by allowing them to import transactions from bank and credit card accounts. It offers features like as automatic transaction categorization, bill reminders, investment tracking, and tax reporting, and is accessible in desktop and cloud-based versions.